st louis county personal property tax on car

Declarations are due by April 1st of every year. You are in an active bankruptcy Form 4491 Government.

Collector Of Revenue Faqs St Louis County Website

Or an Application for Missouri Title in your name or out-of- state registration of your car.

. Visit the State Tax Commission for a list of assessors. How is personal property tax calculated in St Louis County. Leave this field blank.

The division provides health-related information on various. Obtain a Tax Waiver Statement of Non-Assessment Residents with no personal property tax assessed in the prior year can obtain a statement of non-assessment tax-waiver Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. However the city.

Obtain a Real Estate Tax Receipt Instructions for how to find. St Louis County Vector Control. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov.

You pay tax on the sale price of the unit less any trade-in or rebate. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information. You moved to Missouri from out-of-state.

If April 1st is a Saturday or Sunday then the due date will be. It is your responsibility to establish and close accounts as you move across jurisdictions. You may be entitled to a personal property tax waiver if you were not required to pay personal property taxes in the previous year s.

If you opt to visit in person please. On average the property tax on real estate in St. Take your vehicle registration or title and a checkbook.

Louis County is 141 percent which is the highest rate of any county in the state. Your feedback was not sent. USPS mail or Drop-Off in the Clayton Lobby.

The personal property department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. If you did not owe personal property taxes in Missouri during the last year or two years for a two-year registration you will need a Statement of Non-Assessment from your county or city of St. Louis personal property tax history print a tax receipt andor proceed to payment.

You can also obtain a receipt for 100 at one of our offices. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. 6121 N Hanley Rd.

The deadline for the. If April 1st is a Saturday or Sunday then the due date will be. Where do i pay my personal property tax st louis county.

Collector of Revenue 41 S. Personal property account numbers begin with the letter I like in Individual followed by numbers. The median property tax on a 17930000 house is 163163 in Missouri.

You can also obtain a receipt for 100 at one of our. Assessing Personal Property Tax. LOUIS Personal property tax bills are showing up in mailboxes across the area and you may notice you owe more on your vehicle this year.

Louis assessor stating that you did not owe personal property tax for that time period. Business personal property issues can only be addressed at our Clayton location. Personal property taxes are usually assessed as a percentage of the value of an item.

If you opt to visit in person please schedule an appointment. The Assessment lists are mailed by the Assessors Office in January of each year. Saint Louis MO 63134.

The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and. Louis County Assessor Jake Zimmerman warned taxpayers earlier this year to keep a close eye on the declarations because your car may be worth more than expected. It should be registered at your home address.

County Parish Government. To declare your personal property declare online by April 1st or download the printable forms. Central Ave Clayton MO 63105 and include the.

Collector of Revenue - St. Missouris effective vehicle tax rate according to the study is 272 percent which means the owner of a new Toyota Camry LE four-door sedan 2018s highest-selling car valued at 24350 as of February 2019 would pay 864 annually in taxation on the vehicle. Louis county tax appraisers office.

Collector of Revenue FAQs. The median property tax on a 17930000 house is 224125 in St. It is also well above the national average.

Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year. Louis County Website. The median property tax on a 17930000 house is 188265 in the United States.

You can look up you personal property using your home address if this is your first car youll likely have to go to the county dept of revenue and get everything sorted. IF TIME IS NOT AN ISSUE you can. Subtract these values if any from the sale.

The Missouri Department of Revenue requires proof of paid personal property taxes or a waiver. Communicable Disease Control is a division of the Saint Louis County Department of Health. If you have questions about whether your vehicle was taxed or the value please contact the Leasing Section at 314-615-5102.

Personal property taxes are based on where you live and what you own on January 1 and accounts do not transfer across jurisdictions. The leasing company will be billed for personal property tax directly. This is your first vehicle.

2014 St Louis County Unclaimed Property By Stltoday Com Issuu

Action Plan For Walking And Biking St Louis County Website

Online Payments And Forms St Louis County Website

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms

Revenue St Louis County Website

Temp Tags New Missouri Vehicle Sales Tax Law Takes Effect In August Fox 2

St Louis County By Stltoday Com Issuu

Action Plan For Walking And Biking St Louis County Website

If Your Goal Is A New Homes By The Start Of The School Year Look No Further Modern Floor Plans Best Home Builders School Year

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

![]()

St Louis County Police Department 555 Crime And Safety Updates Mdash Nextdoor Nextdoor

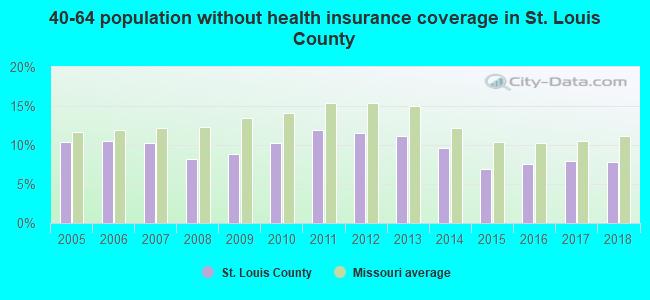

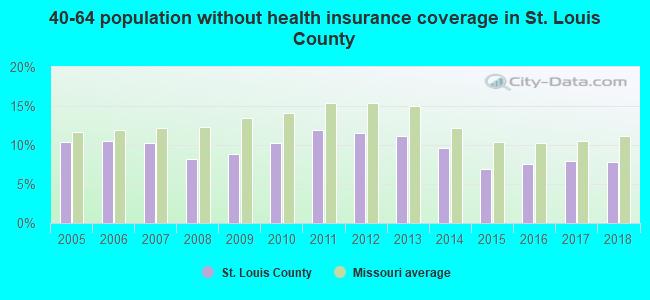

How Healthy Is St Louis County Missouri Us News Healthiest Communities

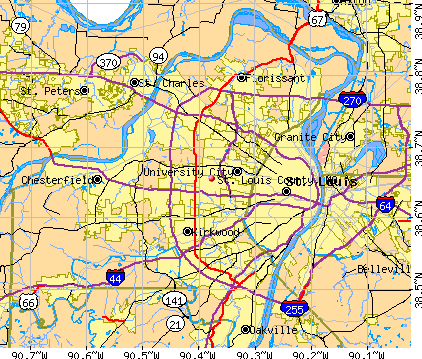

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Sheriff S Office St Louis County Courts

Print Tax Receipts St Louis County Website

2022 Best Places To Buy A House In St Louis Area Niche

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More